About us

01

The Story

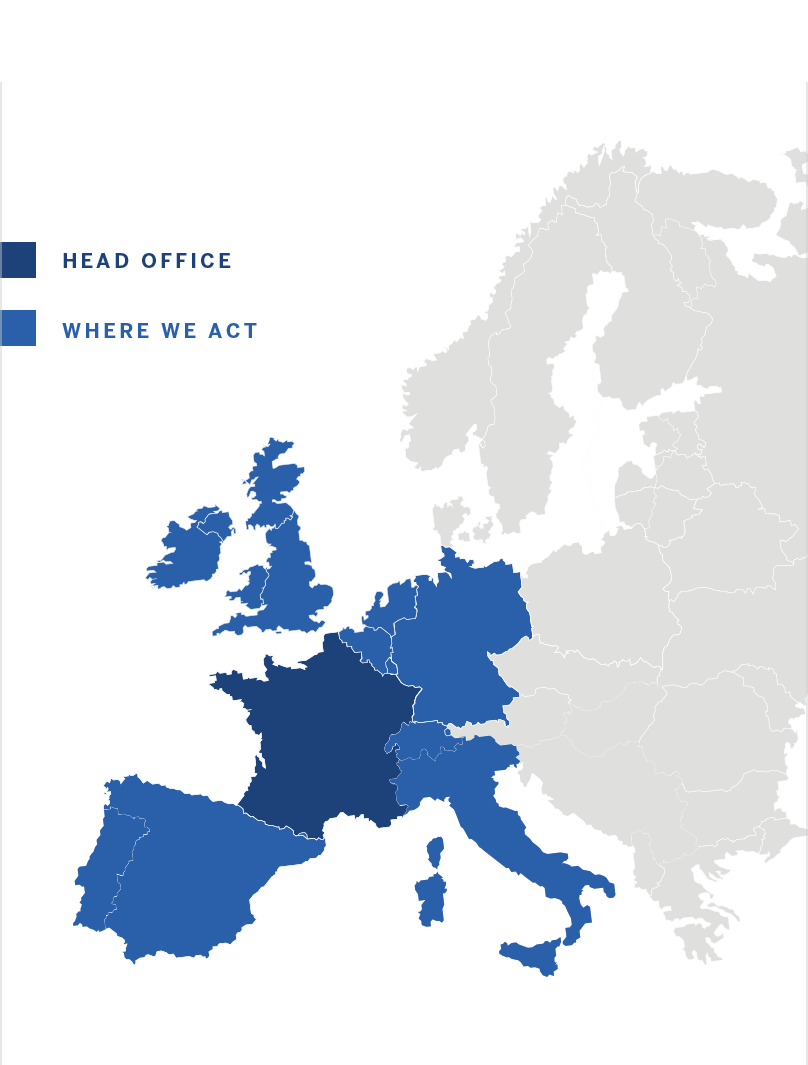

Our focus is Western Europe, with a particular emphasis on France, Germany, BeNelux, Italy, Spain,and the French overseas departments, where our team members have a solid personal track record.

SHIFT CAPITAL, established in 2012 and headquartered in Paris, is a leading independent financial advisory firm in the professional and institutional real estate sector, having advised on more than one hundred and fifty transactions totaling over 6 billion euros. Our mission is to help, advise and assist real estate investors and lenders by connecting them.

SHIFT CAPITAL is registered with ORIAS (organisation for the registration of insurance intermediaries) and as a Broker in Banking Operations and Payment Services (COBSP), as well as a member of the CNCEF Crédit (professional association approved by the ACPR)

02

The team

Our team is driven by principles of integrity and professionalism, while possessing a creative and out-of-the box mind set. We aim to provide tailor-made solutions for every kind of issue which is put to us.

Sharing the same values of rigor and integrity, the SHIFT CAPITAL team members have gathered their experience from among the most prestigious finance and real estate actors, fusing it to lend their expertise to real estate investment professionals.

The management team has solid expertise in financing and investment transactions, having to their credit more than 85 years experience and € 20 billion in financial structuring and financial project management. They all have in-depth knowledge of market players.

Damien Giguet

Chairman

Damien has 25 years of experience in the investment and financing fields of real estate. Damien held senior positions both at JPMorgan and ABN AMRO where he was in charge of origination for commercial property finance transactions. He was also Head of Financing for continental Europe at LaSalle Investment Management. Prior to this he was Senior Consultant in Jones Lang LaSalle’s Corporate Finance team where he was in charge of sell-side and buy-side instructions for complex portfolios, corporate and sale and leaseback transactions. He began his career at Société Générale in the Real Estate Structured Finance team. Damien graduated from a Masters in Econometrics and a Post Graduate Degree in Real Estate Economics and Finance.

Damien has participated in, advised, and led more than 200 operations totaling 10 billion euros.

Stéphane Adolf

Senior Advisor

Stéphane looks back on 3 decades of experience in international commercial real estate finance. He held senior positions at Eurohypo and Commerzbank where he was in charge of international CRE finance business. His experience covers transaction management, originations, credit risk as well as restructuring through the cycles in most European and Asia-Pacific markets. Stéphane graduated from KEDGE Business School in Bordeaux and holds a MSc in Finance.

Stéphane has participated in, advised, and led more than 50 transactions totaling over 3.5 billion euros and had responsibility over loan portfolios in excess of 25 billion euros.

Micaela Malinverno

Senior Advisor

Micaela has over 25 years experience in finance and real estate. She worked for Morgan Stanley in the Securitized Products Group and CMBS team and held senior positions in the Italian branches of several German mortgage banks, heading, amongst others, the Italian subsidiary of Commerzbank real estate, the lending arm Eurohypo AG in Milan. Micaela also participated, bank-side, in some of Italy's largest financings and restructurings of the past decades, primarily in Milan and Rome. Micaela holds a B.A. in Business Administration from Bocconi University in Milan.

Micaela has participated in, advised and led more than 40 transactions totaling over 3 billion euros and had responsibility over loan portfolios in excess of 10 billion euros.

Ignacio Conde Lucaya

Associate

Ignacio joined Shift Capital as an associate in July 2023. Prior to this, he worked at EY Parthenon in Paris and Barcelona, as a Debt Advisory & Restructuring associate in charge of financial intelligence for struggling companies and the refinancing of their debt, particularly in the real estate sector. Ignacio previously worked for a real estate company in Barcelona, as an analyst responsible for monitoring various investment opportunities within the Spanish hospitality market. He also completed an internship at HI Partners, a long-term investor and administrator of hotels in Europe.

Ignacio holds a double degree in Business Administration and Law from Esade Business School - Ramon Llull University.

Mamoun Essakalli

Analyst

Mamoun joined Shift Capital in January 2025. Previously, he gained experience at a Barcelona-based startup, Apartool, operating in the real estate and hospitality sectors. He held various positions within the financial, strategic,and operational departments. He was specifically responsible for monitoring strategic partnerships with various players in real estate and short-term rentals.

Mamoun is currently a final-year student in the Grande Ecole Program at ESSEC Business School.

Baptiste Chalvignac

Analyst

Baptiste joined Shift Capital in July 2025, following his experience at In Extenso in Paris, where he advised public and private clients on asset valuations, market analysis, and financial modeling in the hospitality sector. He contributed to approximately fifteen projects nationwide, bringing together deep industry knowledge and strong analytical skills.

He holds a Bachelor's degree in Hospitality Management from the École Hôtelière de Lausanne and a Master's degree in Finance from EM Lyon.

Charlotte Pilain

Office Manager

Charlotte joined Shift Capital as an office manager in 2020. Franco-American by birth, she studied history at the University of Edinburgh before landing her first job at UBS in Paris. A translator by training, specialised in the fashion sector, she assisted as an external consultant Lacoste's marketing, press and events departments for nearly a decade.